Blog

- Home

- Blog

- The P/E ratio gives you a quick look at market expectations and how a company is being valued compared to its peers.

What is the P/E Ratio in Stock Market? A Simple Guide for Investors

What is the P/E Ratio in Stock Market? A Simple Guide for Investors

When evaluating a stock, one of the most commonly used metrics is the P/E Ratio — or Price-to-Earnings Ratio. It’s a quick way to understand how expensive or cheap a stock is compared to its earnings.

Let’s break it down in simple terms for beginner investors.

❓ What is the P/E Ratio?

The Price-to-Earnings (P/E) Ratio tells you how much investors are willing to pay for every ₹1 of a company's earnings.

🔍 In Simple Words:

If a company has a P/E of 20, investors are paying ₹20 for every ₹1 of the company's earnings.

🧮 How to Calculate P/E Ratio

The formula is very straightforward:

📌 P/E Ratio = Share Price ÷ Earnings Per Share (EPS)

- 📈 Share Price = Current market price of the stock

- 💼 Earnings Per Share (EPS) = Net profit divided by the number of outstanding shares

✅ You can easily find both numbers on financial websites or stock market apps.

📈 Why Does the P/E Ratio Matter?

The P/E ratio gives you a quick look at market expectations and how a company is being valued compared to its peers.

🔍 Understanding High vs Low P/E

🔺 High P/E Ratio

|

📌 What It Means |

📊 Possible Interpretation |

|

Investors expect high growth |

🚀 Future earnings potential |

|

Stock may be overvalued |

⚠️ Priced high due to hype or optimism |

📢 Example: Tech companies often have high P/E ratios due to strong growth expectations.

🔻 Low P/E Ratio

|

📌 What It Means |

📊 Possible Interpretation |

|

Stock may be undervalued |

💰 Good value pick |

|

Could also indicate problems |

⚠️ Slowing growth or company-specific risks |

📢 Example: Traditional industries or struggling companies may show lower P/E ratios.

💡 Quick Tips for Using P/E Ratio

✅ Compare a stock’s P/E to its sector average

✅ Always combine P/E with other financial ratios (like ROE, Debt-Equity)

✅ High P/E ≠ always bad, Low P/E ≠ always good — context is key

✅ Use Forward P/E to evaluate future potential earnings

🧠 Final Thoughts

The P/E Ratio is a valuable starting point for evaluating stocks — but it’s not the full story. Use it along with other tools and always look at the company’s fundamentals, growth prospects, and industry dynamics.

📞 Want to Learn More About Stock Valuation?

Join our expert-led investing workshops or enroll in our Fundamental Analysis for Beginners course.

👉 Contact us! (7753868566) now and take your first step toward smart investing!

rd the phrase: “Volume is the fuel behind price.” But what does that really mean?

In simple terms, Volume tells you how many shares or contracts are being traded during a specific time period. Understanding volume is a powerful tool that can help you identify real price moves, avoid traps, and confirm trends.

Let’s break it down.

❓ What is Volume in Trading?

📌 Volume = Total number of shares traded in a candle (timeframe)

Whether you're looking at a 5-minute, hourly, or daily chart, volume tells you how much trading activity took place in that specific candle.

🔍 Why It Matters:

It shows interest and participation behind a price move.

High volume = more conviction.

Low volume = weak or uncertain move.

📚 How to Use Volume in Trading

Here are 5 simple but powerful ways to read volume as a beginner:

1️⃣ 📈 Price Up + Volume Up = Strong Uptrend

When price moves up with increasing volume, it shows buyers are confident and entering the market strongly.

2️⃣

📉 Price Down + Volume Up = Strong Downtrend

If prices are falling and volume is rising, it confirms strong selling pressure and a potential continuation of the downtrend.

3️⃣ 🚀 Breakout + High Volume = Confirmed Move

When a stock breaks above resistance or below support with high volume, it suggests the breakout is real and backed by strong interest.

4️⃣ ⚠️ Breakout + Low Volume = Weak or False Move

Breakouts without volume are often fakeouts. Price may pull back soon after the breakout.

5️⃣ 💥 Volume Spike = Possible Big Move or Reversal

A sudden spike in volume can signal a major move or even a trend reversal. Watch closely for confirmation through price action.

💡 Quick Tips for Beginners

✅ Look for 2x average volume on breakouts for confirmation

✅ Combine volume with candlestick patterns for better entry/exit signals

✅ Use volume to confirm trend strength – don’t trade against a strong volume-supported trend

✅ Avoid low-volume zones – they often bring choppy, uncertain moves

🔍 Example: Visualizing Volume with a Breakout

Imagine a stock is stuck in a range for weeks. Suddenly, it breaks above resistance with volume 3 times the average. That’s a sign of serious buying interest. It’s more likely to continue the uptrend than if it had broken out on weak volume.

📌 Final Thoughts

Volume is a trader's best friend when used correctly. It helps you:

- Avoid false breakouts

- Confirm trend strength

- Time your entries and exits

You don’t need to be a pro — just start by watching how price reacts with volume, and you'll start spotting stronger, more reliable setups.

📞 Want to Learn How Pros Use Volume?

Join our beginner-to-advanced trading courses or speak to a mentor who can help you build volume-based strategies tailored to your goals.

👉 Contact us! (7753868566) today and level up your trading game!

esting through SIP (Systematic Investment Plan) has become one of the most trusted ways to build long-term wealth. Whether you're planning for retirement, your child’s future, or achieving financial freedom, SIPs can help you reach your goals — step by step.

According to a report by NDTV Profit, you can accumulate ₹3 crore by investing monthly through SIPs, provided you start early and stay consistent.

📈 What is SIP & Why It Works

A SIP is a disciplined way of investing a fixed amount regularly in mutual funds. The biggest advantage is power of compounding — where not just your investment, but even the returns on it keep growing over time.

💰 Monthly SIP Needed to Reach ₹3 Crore

Here’s how much you need to invest monthly at a 12% annual return to reach your ₹3 crore goal:

|

🕒 Duration |

💸 Monthly SIP |

💼 Total Investment |

📊 Wealth Gained |

|

20 Years |

₹30,026 |

₹72.06 Lakhs |

₹2.28 Crore |

|

25 Years |

₹15,810 |

₹47.43 Lakhs |

₹2.52 Crore |

|

30 Years |

₹8,499 |

₹30.59 Lakhs |

₹2.69 Crore |

✅ These figures are based on assumed 12% annual returns. Actual performance may vary depending on market conditions.

💡 Key Learnings

🕒 1. Start Early

What is the P/E Ratio in Stock Market? A Simple Guide for Investors

When evaluating a stock, one of the most commonly used metrics is the P/E Ratio — or Price-to-Earnings Ratio. It’s a quick way to understand how expensive or cheap a stock is compared to its earnings.

Let’s break it down in simple terms for beginner investors.

❓ What is the P/E Ratio?

The Price-to-Earnings (P/E) Ratio tells you how much investors are willing to pay for every ₹1 of a company's earnings.

🔍 In Simple Words:

If a company has a P/E of 20, investors are paying ₹20 for every ₹1 of the company's earnings.

🧮 How to Calculate P/E Ratio

The formula is very straightforward:

📌 P/E Ratio = Share Price ÷ Earnings Per Share (EPS)

- 📈 Share Price = Current market price of the stock

- 💼 Earnings Per Share (EPS) = Net profit divided by the number of outstanding shares

✅ You can easily find both numbers on financial websites or stock market apps.

📈 Why Does the P/E Ratio Matter?

The P/E ratio gives you a quick look at market expectations and how a company is being valued compared to its peers.

🔍 Understanding High vs Low P/E

🔺 High P/E Ratio

|

📌 What It Means |

📊 Possible Interpretation |

|

Investors expect high growth |

🚀 Future earnings potential |

|

Stock may be overvalued |

⚠️ Priced high due to hype or optimism |

📢 Example: Tech companies often have high P/E ratios due to strong growth expectations.

🔻 Low P/E Ratio

|

📌 What It Means |

📊 Possible Interpretation |

|

Stock may be undervalued |

💰 Good value pick |

|

Could also indicate problems |

⚠️ Slowing growth or company-specific risks |

📢 Example: Traditional industries or struggling companies may show lower P/E ratios.

💡 Quick Tips for Using P/E Ratio

✅ Compare a stock’s P/E to its sector average

✅ Always combine P/E with other financial ratios (like ROE, Debt-Equity)

✅ High P/E ≠ always bad, Low P/E ≠ always good — context is key

✅ Use Forward P/E to evaluate future potential earnings

🧠 Final Thoughts

The P/E Ratio is a valuable starting point for evaluating stocks — but it’s not the full story. Use it along with other tools and always look at the company’s fundamentals, growth prospects, and industry dynamics.

📞 Want to Learn More About Stock Valuation?

Join our expert-led investing workshops or enroll in our Fundamental Analysis for Beginners course.

👉 Contact us! (7753868566) now and take your first step toward smart investing!

The earlier you begin your SIP journey, the smaller your monthly investment required. Time is your best financial friend.

📈 2. Benefit from Compounding

With a longer time horizon, your money not only grows — it gro

Related Post

Aap Course Complete Hone Ke Baad Kis Tarah Ka Support Expect Karte Hain

Classroom me aapne theory, strategies, charts, aur indicators seekh liye — lekin asli challenge tab shuru hota hai jab aap live market me apne decisions khud lete hain.

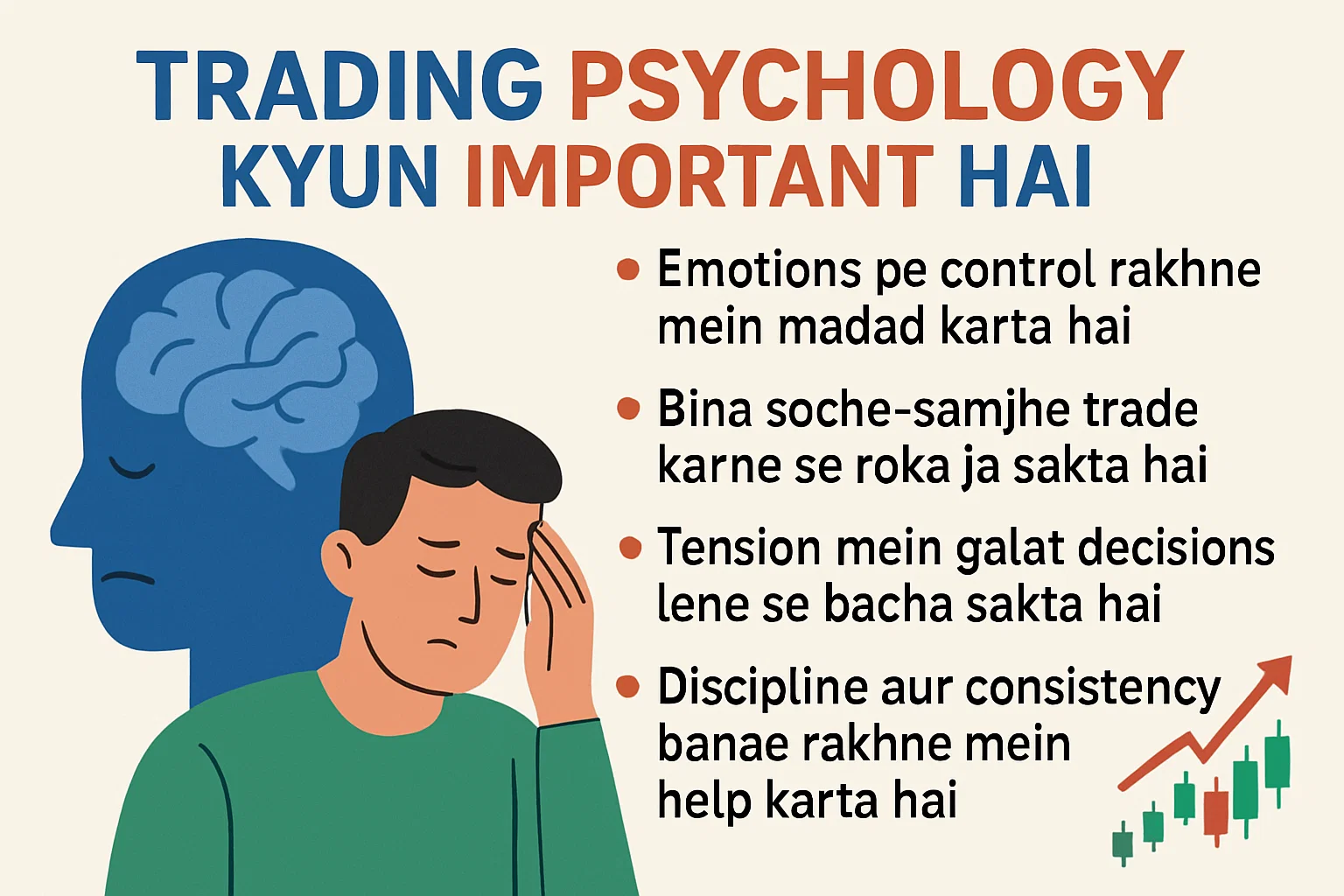

Trading psychology kyun important hai?

Stock market mein paisa kamaana sirf charts padhne, indicators samajhne ya news follow karne se nahi hota.yani aapka sochne ka tareeka, discipline, aur emotions ko control karne ki ability — aapki success ka sabse bada factor hota hai.

Best Trading Institute In India

Welcome to ProfitVedha Private Limited – Your Trusted Partner in Stock Market Education!

Read More