Blog

- Home

- Blog

- A Beginner’s Guide to Market Capitalization in Indian Stock Markets

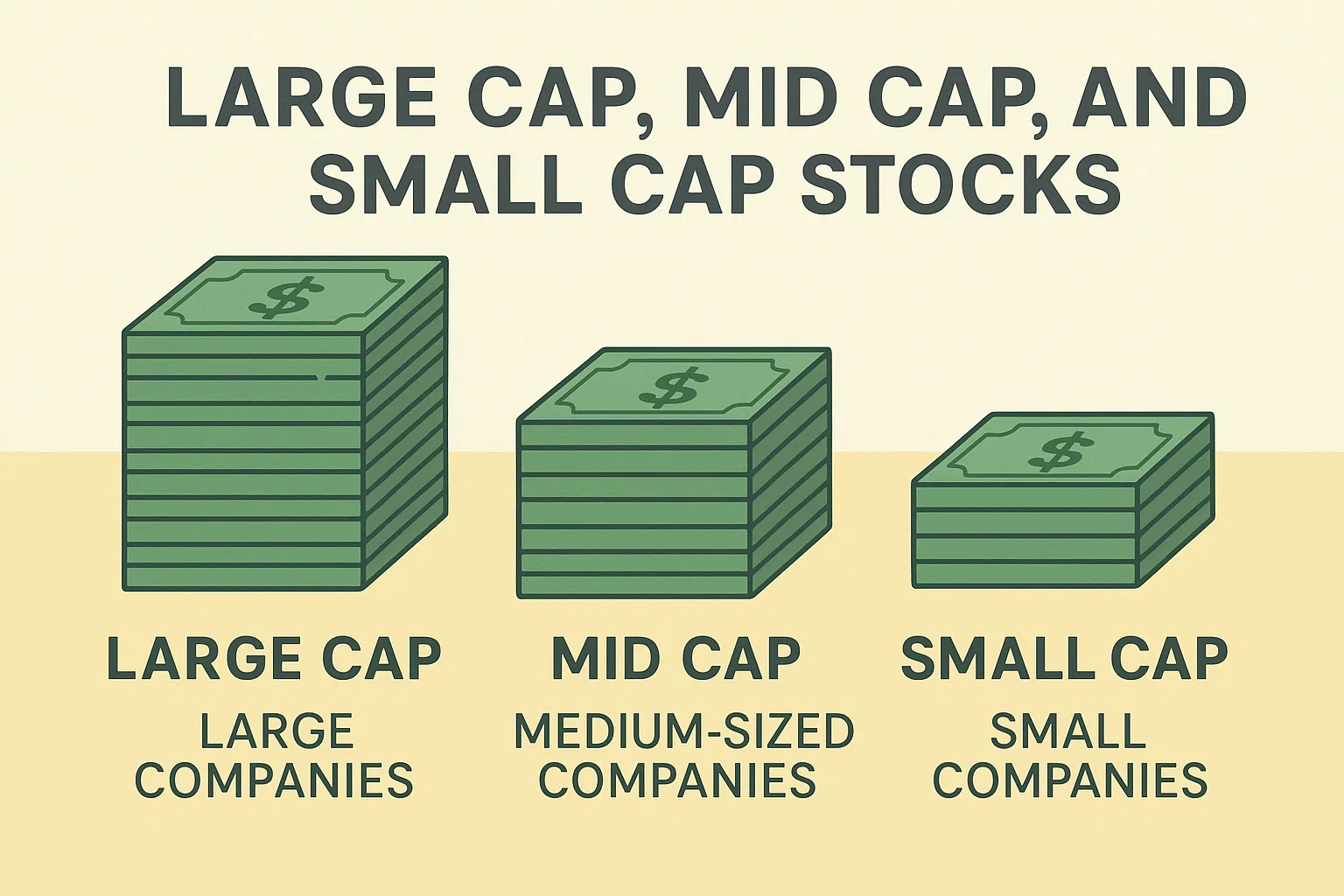

What are Large Cap, Mid Cap, and Small Cap Stocks?

📘 Market Capitalization in Indian Stock Market – Ek Aam Aadmi Style Guide

Stock market ke maze me ghusne se pehle, kuch cheezein samajhna bahut zaroori hota hai.

Jaise… La📘 Market Capitalization in Indian Stock Market – Ek Aam Aadmi Style Guide

Stock market ke maze me ghusne se pehle, kuch cheezein samajhna bahut zaroori hota hai.

Jaise… Large Cap, Mid Cap, Small Cap — yeh sirf terms nahi, yeh bata dete hain ki aap kis level ki company ke saath game khel rahe ho.

Mujhe pehli investment yaad hai… dost ne bola, “Reliance lele, safe hai”. Maine poocha, “Kyun safe?” Tab jaake pata chala market capitalization naam ki ek cheez hoti hai. Tab se yeh meri investing dictionary ka pehla word ban gaya.

Aap bhi samajh lo, taaki agla stock pick andha teer na ho.

📌 Market Capitalization kya hota hai?

Simple language me — Company ki poori market value.

Formula:

Market Cap = Current Share Price × Total Outstanding Shares

Socho, agar aap poori company kharidne chale gaye, to poora bill kitna aayega — wahi iska market cap hai. Aur isi size ke hisaab se company ki category decide hoti hai.

🏢 Large Cap – Bade Bhaisahab of Stock Market

Market Cap: ₹20,000 crore se zyada

Examples: Reliance Industries, Infosys, HDFC Bank, TCS

Yeh waisi companies hain jo market ke senior players hain — experience, brand value aur trust sab kuch full. Market me tufan bhi aa jaye, yeh zyada nahi hilte.

Kyun log pasand karte hain:

Stability achhi hoti hai

Dividend dene ki history hoti hai

Risk kam hota hai

Kis type ke log invest karein: Jo safe play karte hain aur lambi race ke ghode dhoondte hain.

🏭 Mid Cap – Growth ke Superstars

Market Cap: ₹5,000 crore – ₹20,000 crore

Examples: Tata Power, Deepak Nitrite, Ashok Leyland

Yeh players abhi full potential par nahi hai lekin speed se grow kar rahe hain. Kabhi kabhi inke results dekh ke market ka mood hi badal jata hai.

Kyun log pasand karte hain:

Growth potential zyada

Risk aur return ka balance

Future ke large cap ban sakte hain

Suitable for: Log jo stable se thoda zyada risk lene ko ready hain.

🏗️ Small Cap – Stock Market ke Wild Cards

Market Cap: ₹5,000 crore se kam

Examples: Brightcom Group, Tanla Platforms, MapmyIndia

Yeh companies chhoti hoti hai, naam sabko pata bhi nahi hota… lekin agar sahi chal gayi, to multiple times returns de sakti hai.

Lekin galat pick hua to paisa doobne ka chance bhi zyada hota hai.

Kyun log pasand karte hain:

Jackpot wali growth ka chance

Naye leaders ban sakte hain

Warning: High risk. Sirf wahi paisa lagao jo risk kar sakte ho.

📊 Risk vs Return Table

Category Risk Return Potential Stability Horizon

Large Cap Low Moderate High 5+ yrs

Mid Cap Medium High Medium 3–7 yrs

Small Cap High Very High Low 7+ yrs

🧠 Portfolio Mix – Mera Simple Thumb Rule

Large Cap – 50% (Stable base)

Mid Cap – 30% (Growth ka boost)

Small Cap – 20% (High reward bets)

Yeh ratio fixed nahi — apne risk level aur goals ke hisaab se badal sakte ho.

💡 Mere Personal Tips

Har saal portfolio check karke rebalance karo

SIP karo — market ka mood har week badalta hai, lekin SIP se average ban jata hai

Sirf news ya tips pe mat chalna, apna research karo

Company ka size hi nahi, sector ka trend bhi dekho

Bottom Line:

Market capitalization samajh ke aap stock ko sirf naam se nahi, size aur capacity se judge kar paoge. Aur jab size, growth aur risk ka balance clear ho jata hai… portfolio bhi strong ban jata hai.

If you want, I can now weave in 2-3 real Indian stock kahaniyaan jahan ek chhota stock bada ban gaya — jaise Eicher Motors ka journey, ya Page Industries ka rise — jo article ko 100% human, engaging aur SEO gold bana dega.rge Cap, Mid Cap, Small Cap — yeh sirf terms nahi, yeh bata dete hain ki aap kis level ki company ke saath game khel rahe ho.

Mujhe pehli investment yaad hai… dost ne bola, “Reliance lele, safe hai”. Maine poocha, “Kyun safe?” Tab jaake pata chala market capitalization naam ki ek cheez hoti hai. Tab se yeh meri investing dictionary ka pehla word ban gaya.

Aap bhi samajh lo, taaki agla stock pick andha teer na ho.

📌 Market Capitalization kya hota hai?

Simple language me — Company ki poori market value.

Formula:

Market Cap = Current Share Price × Total Outstanding Shares

Socho, agar aap poori company kharidne chale gaye, to poora bill kitna aayega — wahi iska market cap hai. Aur isi size ke hisaab se company ki category decide hoti hai.

🏢 Large Cap – Bade Bhaisahab of Stock Market

Market Cap: ₹20,000 crore se zyada

Examples: Reliance Industries, Infosys, HDFC Bank, TCS

Yeh waisi companies hain jo market ke senior players hain — experience, brand value aur trust sab kuch full. Market me tufan bhi aa jaye, yeh zyada nahi hilte.

Kyun log pasand karte hain:

Stability achhi hoti hai

Dividend dene ki history hoti hai

Risk kam hota hai

Kis type ke log invest karein: Jo safe play karte hain aur lambi race ke ghode dhoondte hain.

🏭 Mid Cap – Growth ke Superstars

Market Cap: ₹5,000 crore – ₹20,000 crore

Examples: Tata Power, Deepak Nitrite, Ashok Leyland

Yeh players abhi full potential par nahi hai lekin speed se grow kar rahe hain. Kabhi kabhi inke results dekh ke market ka mood hi badal jata hai.

Kyun log pasand karte hain:

Growth potential zyada

Risk aur return ka balance

Future ke large cap ban sakte hain

Suitable for: Log jo stable se thoda zyada risk lene ko ready hain.

🏗️ Small Cap – Stock Market ke Wild Cards

Market Cap: ₹5,000 crore se kam

Examples: Brightcom Group, Tanla Platforms, MapmyIndia

Yeh companies chhoti hoti hai, naam sabko pata bhi nahi hota… lekin agar sahi chal gayi, to multiple times returns de sakti hai.

Lekin galat pick hua to paisa doobne ka chance bhi zyada hota hai.

Kyun log pasand karte hain:

Jackpot wali growth ka chance

Naye leaders ban sakte hain

Warning: High risk. Sirf wahi paisa lagao jo risk kar sakte ho.

📊 Risk vs Return Table

Category Risk Return Potential Stability Horizon

Large Cap Low Moderate High 5+ yrs

Mid Cap Medium High Medium 3–7 yrs

Small Cap High Very High Low 7+ yrs

🧠 Portfolio Mix – Mera Simple Thumb Rule

Large Cap – 50% (Stable base)

Mid Cap – 30% (Growth ka boost)

Small Cap – 20% (High reward bets)

Yeh ratio fixed nahi — apne risk level aur goals ke hisaab se badal sakte ho.

💡 Mere Personal Tips

Har saal portfolio check karke rebalance karo

SIP karo — market ka mood har week badalta hai, lekin SIP se average ban jata hai

Sirf news ya tips pe mat chalna, apna research karo

Company ka size hi nahi, sector ka trend bhi dekho

Related Post

Aap Course Complete Hone Ke Baad Kis Tarah Ka Support Expect Karte Hain

Classroom me aapne theory, strategies, charts, aur indicators seekh liye — lekin asli challenge tab shuru hota hai jab aap live market me apne decisions khud lete hain.

Trading psychology kyun important hai?

Stock market mein paisa kamaana sirf charts padhne, indicators samajhne ya news follow karne se nahi hota.yani aapka sochne ka tareeka, discipline, aur emotions ko control karne ki ability — aapki success ka sabse bada factor hota hai.

Best Trading Institute In India

Welcome to ProfitVedha Private Limited – Your Trusted Partner in Stock Market Education!

Read More