Blog

- Home

- Blog

- SWOT analysis for investor

SWOT Analysis for Stock for Smart Investor,s

SWOT Analysis for Stocks: For Smart Investor’s

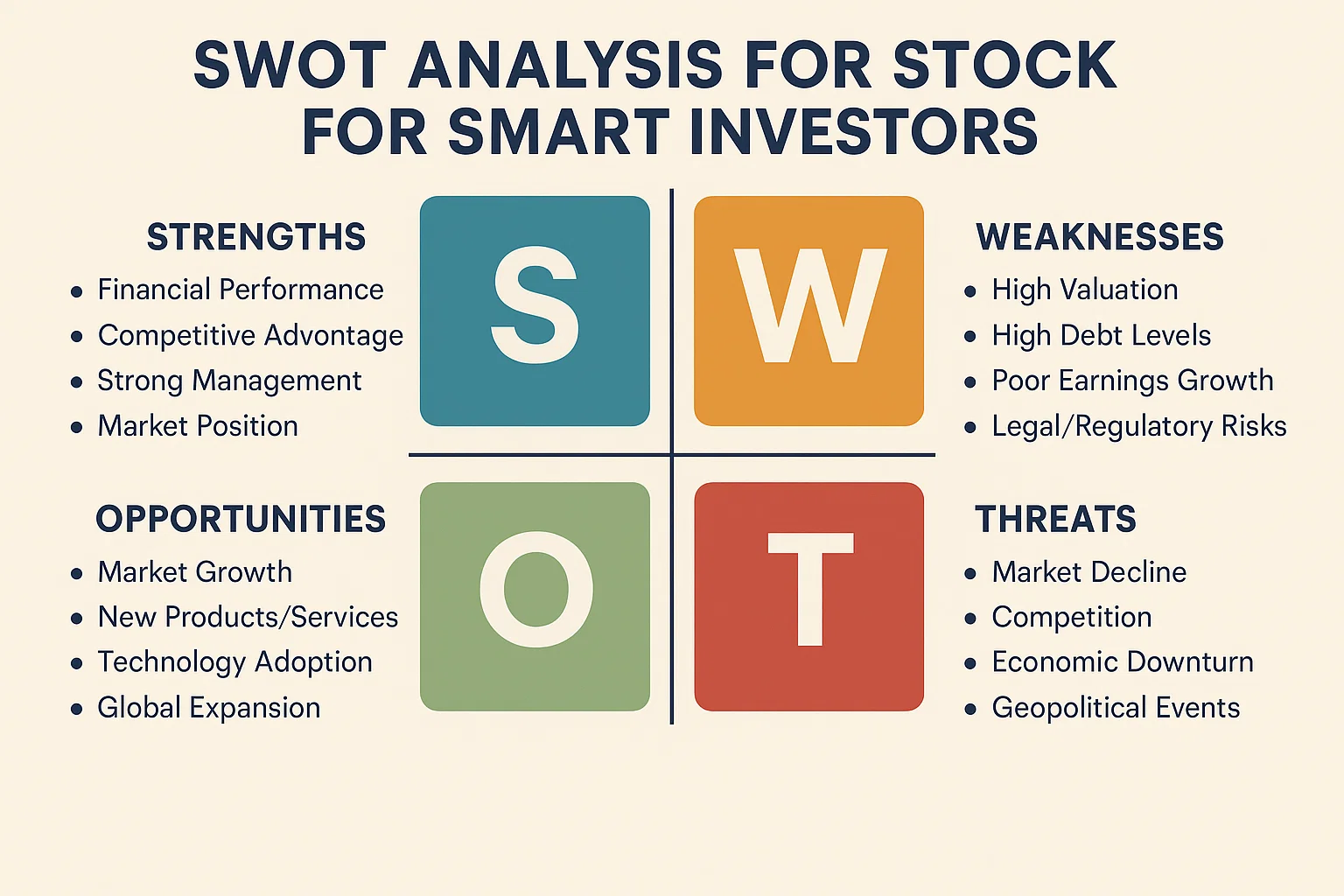

When it comes to investing in the stock market, understanding a company’s fundamentals is crucial. While financial ratios and technical indicators provide valuable data, one often overlooked yet powerful tool is SWOT analysis. Originally used in strategic business planning, SWOT—Strengths, Weaknesses, Opportunities, and Threats—can also help investors assess a company's investment potential holistically.

In this blog, we’ll walk you through how to apply SWOT analysis to stocks, helping you make more informed and confident investment decisions.

📌 What Is a SWOT Analysis?

SWOT Analysis is a structured framework used to evaluate both the internal and external factors that can impact a business. It helps you answer the following critical questions:

- What is the company doing well? (Strengths)

- Where is it lacking? (Weaknesses)

- What growth prospects lie ahead? (Opportunities)

- What risks does it face? (Threats)

This strategic snapshot provides clarity about a company’s overall position in its industry and the market.

🔍 How to Conduct a SWOT Analysis for Stocks

1. ✅ Strengths (Internal, Positive Factors)

These are attributes that give the company a competitive edge.

What to look for:

- Strong brand value and reputation (e.g., Apple, TCS)

- Consistent revenue and profit growth

- Strong balance sheet and low debt

- Market leadership or monopoly in niche

- Efficient management and leadership team

- Competitive advantage (proprietary tech, patents, cost structure)

Example:

Asian Paints has a wide distribution network and brand recall, making it resilient to new market entrants.

2. ❌ Weaknesses (Internal, Negative Factors)

These are internal factors that may hinder the company’s growth or profitability.

What to look for:

- High debt-to-equity ratio

- Poor cash flow management

- Overdependence on a single product or market

- Weak R&D or lack of innovation

- Low-profit margins compared to peers

Example:

A company like Vodafone Idea struggles with high debt and negative cash flow, which could limit future expansion.

3. 🚀 Opportunities (External, Positive Factors)

These are favorable external trends or developments the company can leverage.

What to look for:

- Emerging markets and new customer segments

- Expansion into global markets

- Government reforms or policies in its favor

- Strategic partnerships or acquisitions

- Adoption of new technologies

Example:

Electric vehicle (EV) adoption presents opportunities for battery manufacturers and auto suppliers.

4. ⚠️ Threats (External, Negative Factors)

These are risks or external challenges that could adversely affect the company’s business.

What to look for:

- Regulatory changes or legal troubles

- Intense competition in the industry

- Currency fluctuations for export-dependent firms

- Technological disruption

- Political or geopolitical instability

Example:

IT companies like Infosys and Wipro face threats from stricter H1-B visa norms in the U.S.

🧠 Why Use SWOT Analysis for Investing?

While quantitative metrics tell you what is happening, SWOT analysis tells you why it's happening and whether it is sustainable.

Benefits for Investors:

- Helps compare companies within the same sector

- Improves your risk-reward understanding

- Enables long-term investment decisions

- Balances emotional investing with strategic thinking

📋 Pro Tips for Effective SWOT Analysis

- Use updated data: Ensure the financials and news sources you rely on are current.

- Compare with peers: Always benchmark a company against its competitors.

- Be realistic: Avoid being overly optimistic or pessimistic—focus on evidence.

- Mix it with numbers: Combine SWOT insights with ratio analysis, quarterly results, and technical charts.

Related Post

Aap Course Complete Hone Ke Baad Kis Tarah Ka Support Expect Karte Hain

Classroom me aapne theory, strategies, charts, aur indicators seekh liye — lekin asli challenge tab shuru hota hai jab aap live market me apne decisions khud lete hain.

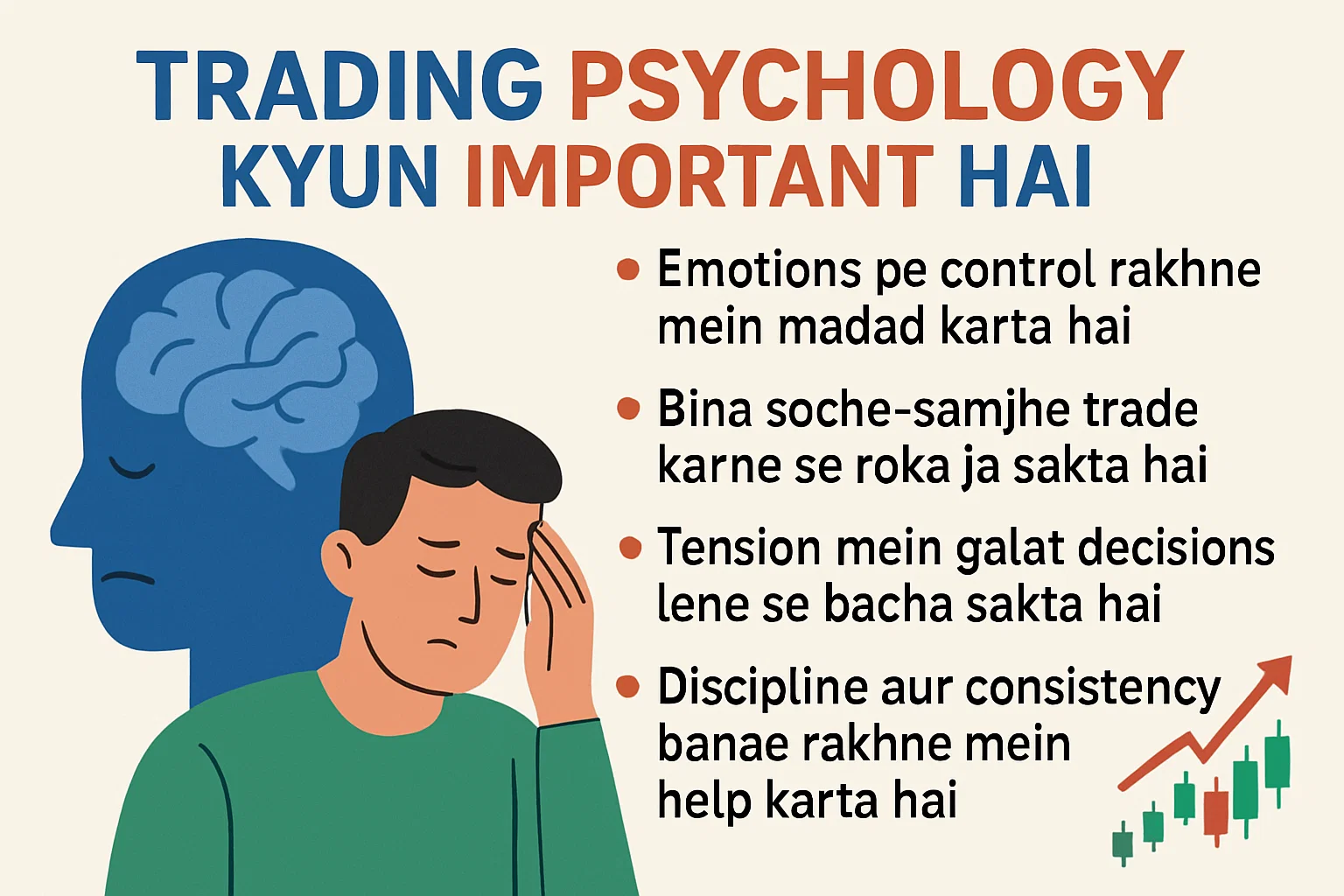

Trading psychology kyun important hai?

Stock market mein paisa kamaana sirf charts padhne, indicators samajhne ya news follow karne se nahi hota.yani aapka sochne ka tareeka, discipline, aur emotions ko control karne ki ability — aapki success ka sabse bada factor hota hai.

Best Trading Institute In India

Welcome to ProfitVedha Private Limited – Your Trusted Partner in Stock Market Education!

Read More