Blog

- Home

- Blog

- SIP vs. Lump-Sum Investment – Which is Better in India?

SIP vs. Lump-Sum Investing: What Should Indian Investors Choose?

💸 SIP vs. Lump-Sum Investing for Indian Investors

A Practical Comparison to Help You Invest Smarter | By ProfitVedha

When it comes to investing in mutual funds or the stock market, two popular strategies dominate the discussion: Systematic Investment Plan (SIP) and Lump-Sum Investment.

So, which one is better for Indian investors? Let's explore the differences, benefits, and best use cases of both.

📆 What is SIP (Systematic Investment Plan)?

A SIP allows you to invest a fixed amount regularly — monthly, weekly, or quarterly — in a mutual fund scheme.

✅ Pros of SIPs -

📉 Rupee Cost Averaging – Buy more units when prices are low

📈 Disciplined Investing – Cultivates regular saving habit

🛡️ Lower Risk – Reduces impact of market volatility

🧍 Great for Salaried Individuals – Easy to invest from monthly income

🔁 Automatic & Flexible – Can start, stop or increase anytime

❌ Cons of SIPs –

⏳ Slower Wealth Accumulation – Returns build up over time

📊 Returns Depend on Market Timing – Might miss quick market rallies

💰 No Benefit if Market Consistently Rises – Lump-sum might outperform

💰 What is Lump-Sum Investing?

Lump-Sum means investing a large amount of money in one go — often from bonuses, business profits, or idle savings.

✅ Pros of Lump-Sum Investing

🚀 Higher Returns in Bull Markets – Capitalizes on rising trends

⏱️ Quick Capital Deployment – Invest idle funds efficiently

📊 Better for Long-Term Growth – If market timing is right

🧠 No Monthly Hassles – One-time decision

❌ Cons of Lump-Sum Investing

⚠️ Market Timing Risk – Can lead to loss if invested at a peak

🧍♂️ Not Suitable for Beginners – Requires experience & courage

📉 High Volatility Exposure – No averaging like SIPs

💸 Psychological Stress – Bigger emotional roller coaster

🧮 SIP vs. Lump-Sum – Quick Comparison Table

|

Feature |

SIP (Systematic Investment Plan) |

Lump-Sum Investment |

|

Investment Mode |

Small regular amounts |

One-time large amount |

|

Market Timing Risk |

Low |

High |

|

Best For |

Salaried individuals, beginners |

Experienced, windfall gain |

|

Volatility Management |

Better (via rupee cost averaging) |

Poor |

|

Emotional Stress |

Low |

High |

|

Suitable Market Scenario |

Volatile/uncertain |

Bullish/strong markets |

🧠 Expert Advice from ProfitVedha

🎯 Choose SIP if:

- You have a monthly income

- You are new to investing

- You want to avoid timing the market

💼 Choose Lump-Sum if:

- You have a large amount ready to invest

- You’re confident about market direction

- You’re investing for long-term goals

💡 Smart Strategy:

👉 You can even combine both! Start with lump-sum and continue with SIPs for a balanced approach.

📞 Need Any Help Choosing the Right Investment Plan?

At ProfitVedha, our expert financial mentors help you build a plan based on your income, goals, and risk profile.

🔗 Visit: www.profitvedha.com

📈 Enroll in our Mutual Fund & Wealth Creation Programs

📞 Contact US ! on 7753868566 & Get a personalized consultation with our certified trainers!

Related Post

Aap Course Complete Hone Ke Baad Kis Tarah Ka Support Expect Karte Hain

Classroom me aapne theory, strategies, charts, aur indicators seekh liye — lekin asli challenge tab shuru hota hai jab aap live market me apne decisions khud lete hain.

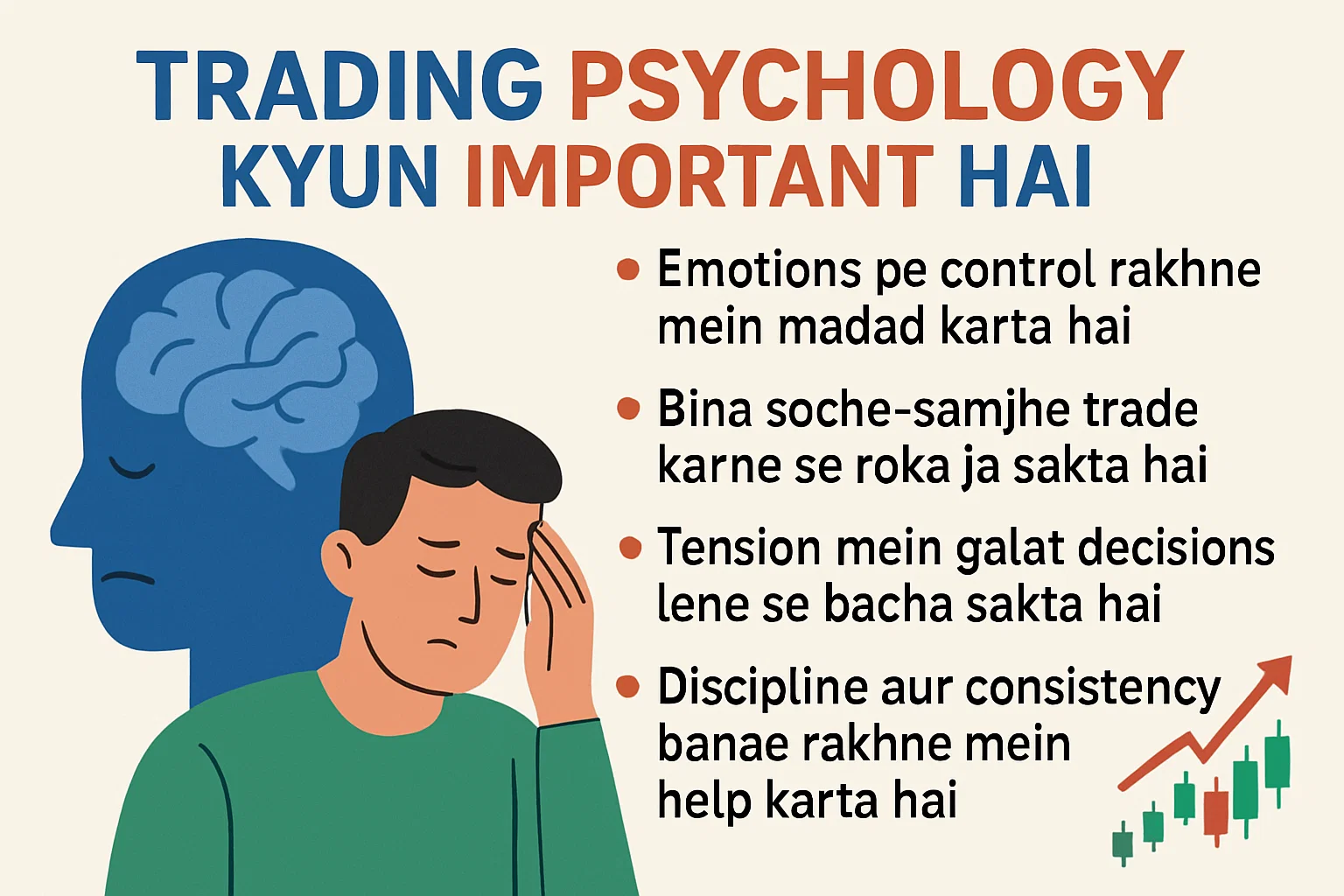

Trading psychology kyun important hai?

Stock market mein paisa kamaana sirf charts padhne, indicators samajhne ya news follow karne se nahi hota.yani aapka sochne ka tareeka, discipline, aur emotions ko control karne ki ability — aapki success ka sabse bada factor hota hai.

Best Trading Institute In India

Welcome to ProfitVedha Private Limited – Your Trusted Partner in Stock Market Education!

Read More