Blog

- Home

- Blog

- Mutual Funds vs. Direct Equity: Pros and Cons Every Investor Must Know

Pros and Cons of Mutual Funds vs. Direct Equity

📈 Mutual Funds vs. Direct Equity: Pros and Cons Every Investor Must Know

By ProfitVedha | Your Partner in Smart Investing

When it comes to growing wealth through the stock market, two common routes dominate – Mutual Funds and Direct Equity (stocks).

But which one is right for you? Let’s break down the advantages and disadvantages of each so you can invest with clarity.

💹 What are Mutual Funds?

Mutual funds pool money from multiple investors and are managed by professional fund managers, who invest the amount across diversified securities like stocks, bonds, and more.

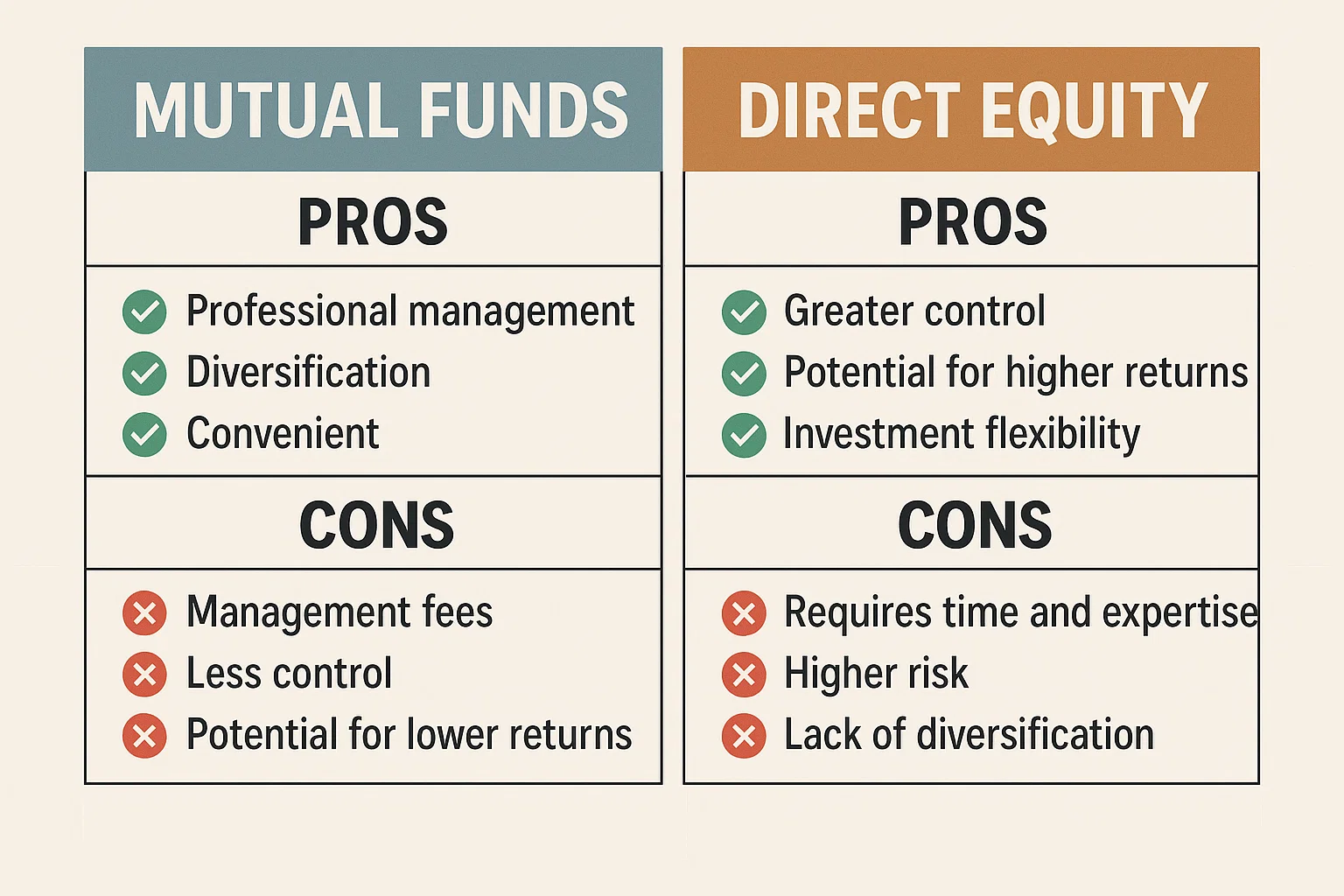

🟢 ✅ Pros of Mutual Funds

🔹 Diversification – Reduces risk by investing in multiple companies

🔹 Professional Management – Experts handle your investments

🔹 Affordable – Start with as low as ₹500 through SIPs

🔹 Tax Benefits – ELSS mutual funds provide tax deductions under Section 80C

🔹 Auto-Pilot Mode – Ideal for people with less market knowledge

🔴 ❌ Cons of Mutual Funds

🔸 Management Fees (Expense Ratio) – Eat into returns

🔸 Less Control – You don’t pick individual stocks

🔸 Returns may vary – Based on fund manager’s skill and market

🔸 Exit Loads/Lock-in – Some funds have restrictions on withdrawal

📊 What is Direct Equity?

Direct equity means investing directly in individual stocks of companies listed on stock exchanges like NSE or BSE. It requires active research and management.

🟢 ✅ Pros of Direct Equity

🔹 Higher Returns Potential – Good stock selection can yield high profits

🔹 Full Control – You choose which companies to invest in

🔹 No Fund Manager Fees – No expense ratio or hidden charges

🔹 Custom Strategies – You can build your own portfolio and strategy

🔴 ❌ Cons of Direct Equity

🔸 High Risk – More volatile and subject to market fluctuations

🔸 Requires Knowledge & Time – Needs constant tracking and learning

🔸 Emotional Decisions – Fear or greed can affect judgement

🔸 Lack of Diversification – Concentration in few stocks increases risk

📚 Mutual Funds vs Direct Equity – At a Glance

|

Feature |

Mutual Funds |

Direct Equity |

|

Risk Level |

Moderate to Low |

High |

|

Control |

Low |

High |

|

Knowledge Needed |

Minimal |

Extensive |

|

Returns Potential |

Moderate |

High (with right skills) |

|

Investment Style |

Passive |

Active |

|

Fees |

Expense ratio applies |

No management fee |

|

Best for |

Beginners & Busy Investors |

Active, experienced investors |

🧠 Final Thoughts from ProfitVedha

🎯 Mutual Funds are great for those looking for low-effort, consistent growth with moderate returns and lower risk.

📈 Direct Equity, on the other hand, is suitable for those with market knowledge, time, and risk appetite.

At ProfitVedha, we help you decide based on your goals, risk profile, and experience.

📞 Ready to Start Your Investment Journey?

👉 Whether you’re a beginner or seasoned investor, ProfitVedha provides tailored courses and expert guidance to help you grow your wealth the smart way.

🔗 Visit: www.profitvedha.com

📞 Contact us! on 7753868566 for 1-on-1 consultation or explore our Mutual Fund & Trading courses today!

Related Post

Aap Course Complete Hone Ke Baad Kis Tarah Ka Support Expect Karte Hain

Classroom me aapne theory, strategies, charts, aur indicators seekh liye — lekin asli challenge tab shuru hota hai jab aap live market me apne decisions khud lete hain.

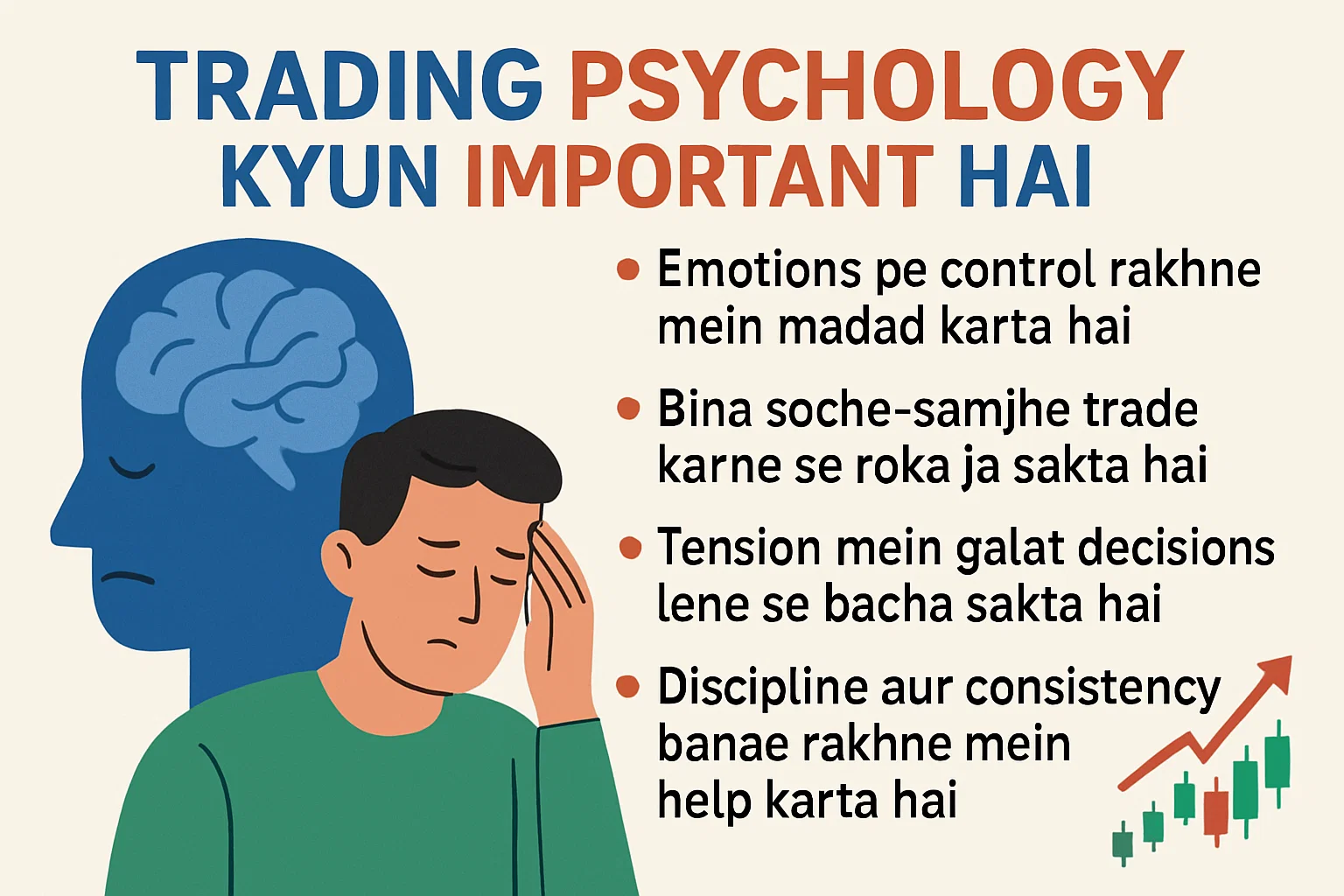

Trading psychology kyun important hai?

Stock market mein paisa kamaana sirf charts padhne, indicators samajhne ya news follow karne se nahi hota.yani aapka sochne ka tareeka, discipline, aur emotions ko control karne ki ability — aapki success ka sabse bada factor hota hai.

Best Trading Institute In India

Welcome to ProfitVedha Private Limited – Your Trusted Partner in Stock Market Education!

Read More