Blog

- Home

- Blog

- aise Identify Karein Ki Kaunsi Stock Investment Ke Liye Achhi Ha

Kaise Identify Karein Ki Kaunsi Stock Investment Ke Liye Achhi Hai?

Investment Goal Samjhein

Sabse pehle apne investment goals clear karein:

- Long term ya short term?

- High risk, high return chahiye ya capital safe rakhna hai?

Aapki need ke hisaab se sector aur stock decide kar sakte hain

2. Fundamental Analysis

Company ki asli value samjhne ke liye:

- Financial Ratios dekhein: P/E Ratio, EPS (Earnings Per Share), Debt-to-Equity, ROE, ROCE

- Revenue aur Profit Growth: Company kitni tezi se grow kar rahi hai?

- Debt position: Zyada debt waali companies risky ho sakti hain.

- Peer Comparison bhi important hai—same sector ki companies ko compare karein

3. Competitive Advantage (Moat)

Kya company ke paas koi aisa unique product/service hai jo dusre provide nahi kar paate? Jaise brand value, patents, cost advantage, etc. Jisse long-term growth possible ho15.

4. Management Quality

Good management = Good decisions. Company ke promoters, board aur unki reputation check karein.

5. Technical Analysis (Agar trading ya short-term dekh rahe hain)

- Price trends, volume analysis, moving averages, RSI, candlestick patterns dekhein

- Charts ka use: Short-term ke liye stock ka historical price performance check karein.

6. News & Public Sentiment

- Financial news, expert blogs, aur market updates regularly follow karein

- Koi bhi bada event jaise quarterly results, new project announcement, ya regulatory changes stocks ko affect kar sakte hain.

7. Dividend Records & Long-term Stability

- Stable aur consistent dividend dene waali companies usually strong.

- Past records mein profits ya dividend ka pattern check karein

Practical Check-list (Quick Steps)

- Business model samjhein.

- Financial statements padhein (balance sheet, P&L, cash flow).

- Key ratios compare karein.

- Long term stability dekhein.

- Promoter holding check karein.

- Sector trends samjhein.

Related Post

Aap Course Complete Hone Ke Baad Kis Tarah Ka Support Expect Karte Hain

Classroom me aapne theory, strategies, charts, aur indicators seekh liye — lekin asli challenge tab shuru hota hai jab aap live market me apne decisions khud lete hain.

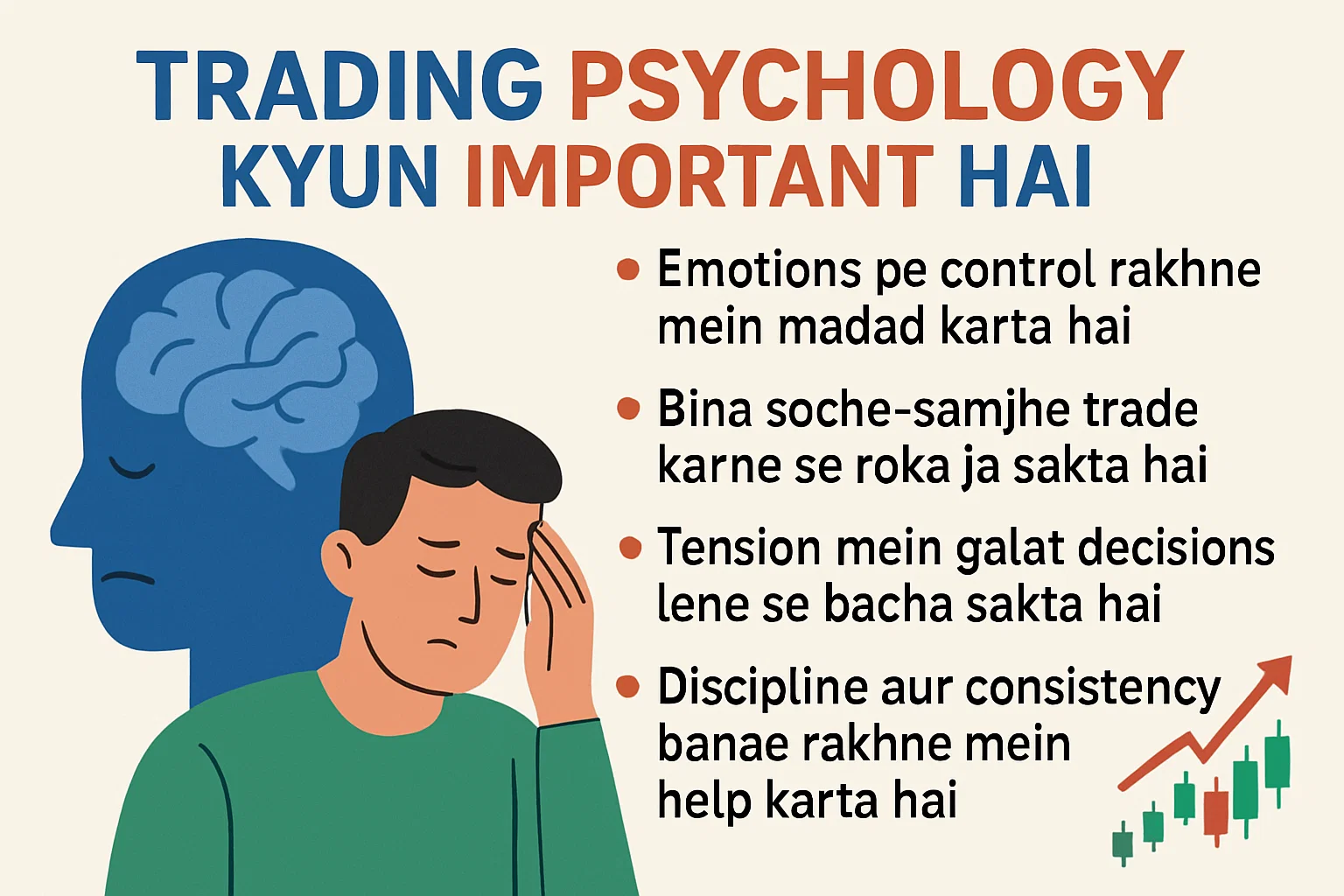

Trading psychology kyun important hai?

Stock market mein paisa kamaana sirf charts padhne, indicators samajhne ya news follow karne se nahi hota.yani aapka sochne ka tareeka, discipline, aur emotions ko control karne ki ability — aapki success ka sabse bada factor hota hai.

Best Trading Institute In India

Welcome to ProfitVedha Private Limited – Your Trusted Partner in Stock Market Education!

Read More