Blog

- Home

- Blog

- Difference Between Stocks and Shares

Difference Between Stocks and Shares

📘Difference Between Stocks and Shares

Understanding the Building Blocks of Stock Market Investing

If you’re new to the world of investing, you’ve likely heard the terms “stocks” and “shares” used interchangeably. While they are closely related, there are subtle differences that every aspiring investor should understand. In this blog, we’ll break down the confusion and introduce you to the basics of stock market investing—in simple and professional terms.

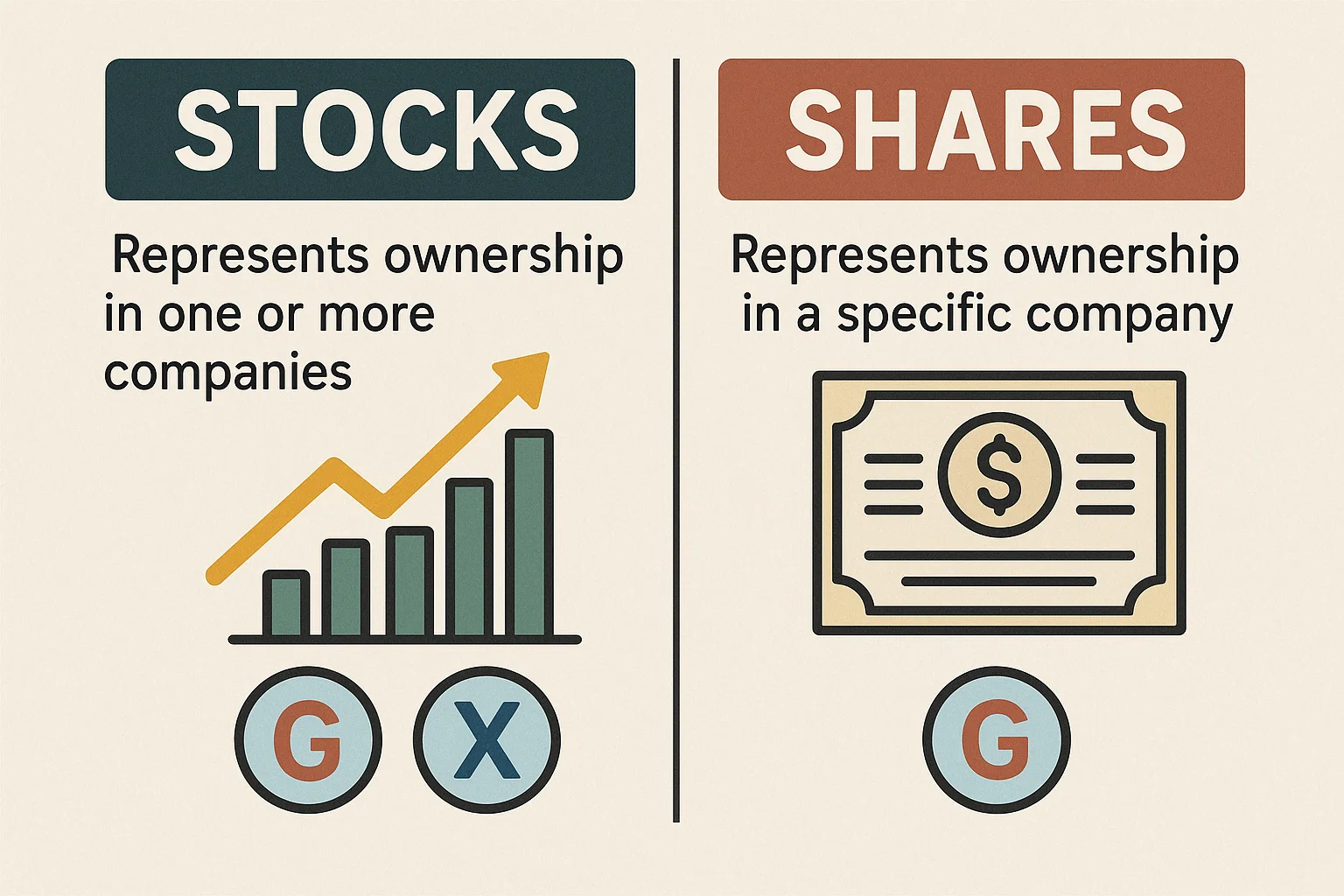

📊 What Are Stocks?

Stocks represent ownership in a company. When you buy a stock, you become a partial owner (shareholder) of that company.

- 🏢 Think of it like this: If a company is a big pizza, owning a stock means you own a slice of that pizza.

- 💼 Stocks are a general term that refers to ownership in one or more companies.

👉 Example:

If you say, “I invest in stocks,” it means you hold ownership in companies like Infosys, Reliance, or TCS.

📈 What Are Shares?

Shares are the individual units of ownership in a specific company’s stock.

- 🔢 They indicate how much of a particular company you own.

- 💰 Shares determine your dividends, voting rights, and claim on profits.

👉 Example:

If you own 100 shares of Infosys, you own a part of Infosys—not just any company.

🆚 Key Differences: Stocks vs. Shares

|

🔍 Feature |

📦 Stocks |

📄 Shares |

|

Definition |

General ownership in companies |

Specific units of ownership |

|

Scope |

Can refer to multiple companies |

Refers to a particular company |

|

Usage in Conversation |

“I invest in stocks.” |

“I own 50 shares of TCS.” |

|

Type |

Can be common or preferred stocks |

Can be equity or preference shares |

|

Ownership clarity |

Broader term |

More specific and quantifiable |

🧠 Why It Matters for New Investors

Understanding the distinction helps you:

- ✅ Communicate like a pro in investment discussions

- 📚 Read financial news and reports more effectively

- 🎯 Make smarter decisions while buying or tracking your investments

📌 Pro Tip for Beginners

“All shares are stocks, but not all stocks are shares.”

This means when you buy shares of one company, you are investing in its stock. But when you say stocks in general, you may be referring to ownership across many companies.

🪙 Types of Shares You Should Know

1. 🟢 Equity Shares

- Represent true ownership

- Carry voting rights

- Subject to market risk and reward

2. 🟡 Preference Shares

- Fixed dividends

- Priority over equity shareholders during liquidation

- Generally no voting rights

🔁 Quick Recap

|

Term |

Meaning |

Example |

|

Stock |

Ownership in one or more companies |

“I invest in Indian IT stocks.” |

|

Share |

Specific unit in a company |

“I own 100 shares of Infosys.” |

Related Post

Aap Course Complete Hone Ke Baad Kis Tarah Ka Support Expect Karte Hain

Classroom me aapne theory, strategies, charts, aur indicators seekh liye — lekin asli challenge tab shuru hota hai jab aap live market me apne decisions khud lete hain.

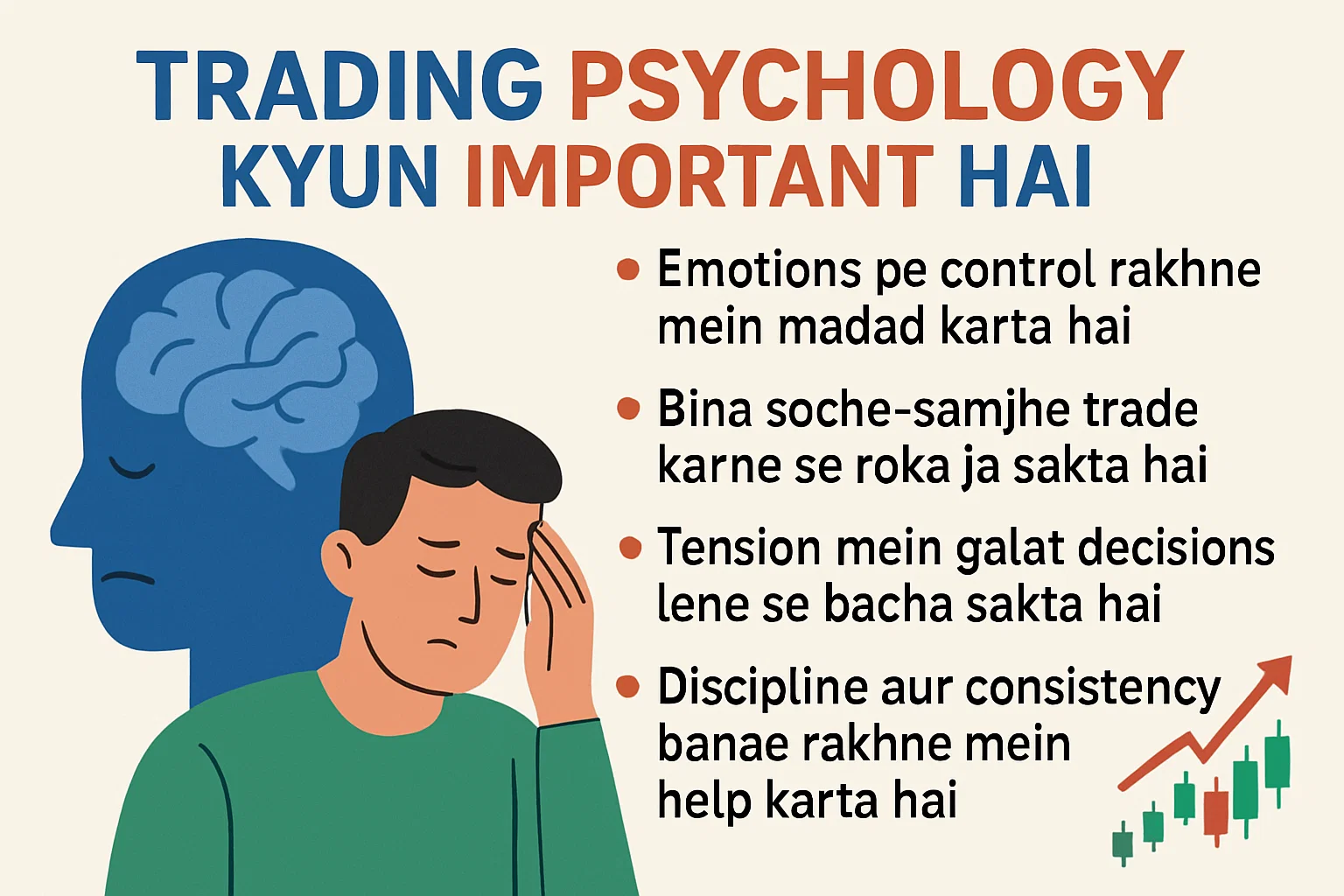

Trading psychology kyun important hai?

Stock market mein paisa kamaana sirf charts padhne, indicators samajhne ya news follow karne se nahi hota.yani aapka sochne ka tareeka, discipline, aur emotions ko control karne ki ability — aapki success ka sabse bada factor hota hai.

Best Trading Institute In India

Welcome to ProfitVedha Private Limited – Your Trusted Partner in Stock Market Education!

Read More